Water utility governing boards serve a critical role in ensuring the provision of clean, safe drinking water. Governing boards are tasked with making important and complex decisions in line with the utility’s mission, and they ultimately serve to keep water utilities accountable to the public. One of the most important roles of a governing board is to protect the utility’s long-term financial health and sustainability. Yet water utility governing board members don’t always have a background in finance or a strong understanding of key financial issues that impact the utility.

Water utility governing boards serve a critical role in ensuring the provision of clean, safe drinking water. Governing boards are tasked with making important and complex decisions in line with the utility’s mission, and they ultimately serve to keep water utilities accountable to the public. One of the most important roles of a governing board is to protect the utility’s long-term financial health and sustainability. Yet water utility governing board members don’t always have a background in finance or a strong understanding of key financial issues that impact the utility.

A new series of educational videos produced by the Environmental Finance Center at UNC Chapel Hill, with support from the Water Research Foundation, offers an engaging, accessible, and easily shareable resource on financial management topics designed specifically for water utility governing boards. The Water₡lips© Video Series describes challenges faced by water utilities across the country using eye-catching visualizations and easy-to-understand explanations of concepts that can otherwise be daunting.

These videos highlight critical financial practices in the industry discussed in the Water Research Foundation’s recently published report “Defining a Resilient Business Model for Water Utilities”, including:

Financial Benchmarking for Water Utilities

Financial metrics are important management tools used by a utility, its board, and funders to measure financial strength, stability, credit worthiness, and growth capabilities. Financial benchmarks are integral to providing long-term guidance for a governing body and in creating a common framework to compare decisions. Utilities and their stakeholders monitor how key financial ratios track over time in order to assess current financial performance, determine if a change in rates or financial policies is needed, and plan for future growth and development of the enterprise.

Financial metrics are important management tools used by a utility, its board, and funders to measure financial strength, stability, credit worthiness, and growth capabilities. Financial benchmarks are integral to providing long-term guidance for a governing body and in creating a common framework to compare decisions. Utilities and their stakeholders monitor how key financial ratios track over time in order to assess current financial performance, determine if a change in rates or financial policies is needed, and plan for future growth and development of the enterprise.

This video explains the importance of financial benchmarking and reviews common metrics used to indicate financial performance, including current ratio, days cash on hand, operating ratio, and debt coverage service ratio.

New Business Models for the Water Industry

As water conservation becomes more important, utilities must cope with declining revenues and the paradoxical relationship between revenue stability and conservation promotion. In addition, there is a large and looming national infrastructure needs gap for which utilities must generate even more revenues to pay for upcoming infrastructure re-investment. Growing uncertainty about the weather, drought, and climate change makes it difficult for utilities to plan for and collect the revenues they need. The predominant water utility business model is not well suited to overcome the modern challenges utilities face.

As water conservation becomes more important, utilities must cope with declining revenues and the paradoxical relationship between revenue stability and conservation promotion. In addition, there is a large and looming national infrastructure needs gap for which utilities must generate even more revenues to pay for upcoming infrastructure re-investment. Growing uncertainty about the weather, drought, and climate change makes it difficult for utilities to plan for and collect the revenues they need. The predominant water utility business model is not well suited to overcome the modern challenges utilities face.

Utilities can continue to work around the margins of their business model, but there is an opportunity for utilities in the industry to adopt a pricing model that better aligns the cost of water to the cost of service.

This video introduces three potential business models that can help a utility meet its operational needs while also sending a clear signal to its customers about the value of water service.

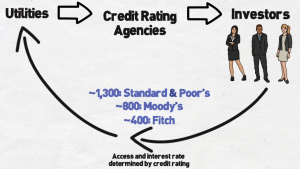

Credit Rating Agency Considerations

Many water utilities borrow money to pay for their infrastructure. Credit ratings play an important role in determining a water utility’s access to, and cost of borrowing, money. Credit ratings are used by potential investors and lenders as an indication of the utility’s ability and willingness to repay its debt on time and in full.

Many water utilities borrow money to pay for their infrastructure. Credit ratings play an important role in determining a water utility’s access to, and cost of borrowing, money. Credit ratings are used by potential investors and lenders as an indication of the utility’s ability and willingness to repay its debt on time and in full.

This video reviews the measurable and less-so-measurable factors credit rating agencies take into account when evaluating water and wastewater utilities, including financial flexibility, capacity, and predictability.

Visit the Water Research Foundation website to view the videos.

This post also appeared on the Environmental Finance Blog of the Environmental Finance Center at UNC Chapel Hill: https://efc.web.unc.edu/2014/10/16/waterclips/