Energy & its Importance for Small WWTPs

Small wastewater treatment plants (WWTPs), which treat less than 1 million gallons per day (MGD), make up 79% of wastewater utilities in the United States and play a crucial role in our communities. WWTPs and drinking water systems account for approximately 2% of energy use in the United States, which can burden budgets and lead to a substantial carbon footprint, adding over 45 million tons of greenhouse gasses annually. By transitioning to solar energy, WWTPs would not only reduce operational costs but also significantly lower their greenhouse gas emissions.

Energy Demands of Small WWTPs

Wastewater treatment is an energy-intensive process, especially for small WWTPs. These facilities typically consume between 5,000 and 7,000 kWh of electricity per million gallons of wastewater treated (MGD), which is two to three times more energy per unit compared to larger facilities. For a small WWTP serving a population of 5,000 people and treating 0.5 MGD, daily energy consumption can reach around 3,000 kWh.

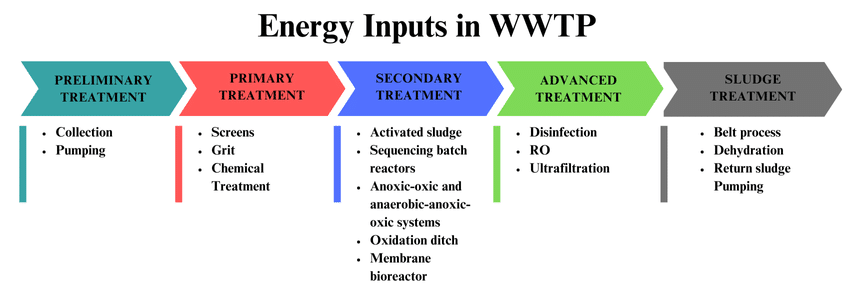

WWTPs need a constant energy supply to power essential processes such as aeration, pumping, and disinfection (as shown in Figure 1). This high level of consumption can quickly drive up costs, often making utility expenses one of the most significant operational burdens for local governments. In fact, energy costs can account for 30% to 40% of a municipality’s total energy bill.

Additionally, because these plants rely on the electrical grid, they are vulnerable to fluctuating energy prices and potential power outages, which can disrupt critical services and impact the community.

Solar for Small WWTPs

The transition to solar energy presents a practical and sustainable solution for WWTPs to reduce their dependence on grid electricity, cut operational costs, and improve the resilience of their critical infrastructure. For example, a 600-kW solar installation could offset the daily energy demand of a small WWTP that consumes around 3,000 kWh of electricity per day to treat 0.5 MGD. The estimated cost for such a solar project is approximately $1.3 million, though this figure may vary depending on factors like local labor rates, permitting requirements, and specific site conditions (see Table 1 for cost calculation assumptions).

| Factor | Value | Unit | Factor | Value | Unit |

| Plant Capacity | 0.5 | MGD | Peak Sun Hours | 5 | Hours |

| Population Served | 5,000 | No. | Required Solar Capacity | 600 | kW |

| Avg. WWTP Energy Use | 6,000 | kWh/MGD | Installation Cost | 2,200 | $/kW |

| Energy Use (Plant X) | 3,000 | kWh/day | Total Solar Cost | 1,320,000 | $ |

Transitioning to solar for small WTTPs allows them to reduce their utility bills as well as their carbon footprint. Additionally, in many states net metering policies and programs allow solar-generating facilities to sell excess energy to the grid, resulting in lower energy costs.

Solar systems have a typical lifespan of over 25 years, and the payback period generally ranges from 6 to 14 years. Moreover, financial incentives such as grants, rebates, and local tax credits can significantly reduce the upfront cost of installing solar. The Inflation Reduction Act (IRA) also introduces a direct pay provision, which can cut both the overall costs and the payback period by up to 50%, making the investment even more attractive and financially viable for municipalities.

Understanding the IRA’s Direct Pay Mechanism for Solar

Historically, tax-exempt entities like local governments have struggled to access renewable energy tax credits, as they do not pay federal income taxes. The IRA’s direct pay provision changes this by allowing these entities to receive equivalent payments from the federal government, effectively offering the same incentives that for-profit organizations enjoy. This direct or elective pay system functions as a refund mechanism that is non-competitive, making it easier for tax-exempt organizations to benefit.

Through the IRA, local governments can take advantage of tax incentives that cover up to 30% of the cost of solar projects. Additional bonus credits are available that can be applied for using domestic content and for projects in energy community or low-income communities. The specific benefits under IRA for a community’s small WWTP can be seen in the table below.

| Factor | Tax Credit | Value |

| Base Tax Credit for <1 MW projects | 30% | $396,000 |

| Siting in Energy or Low-income community | 10% | $132,000 |

| Domestic Content Bonus | 10% | $132,000 |

Installing Solar and Accessing IRA Incentives

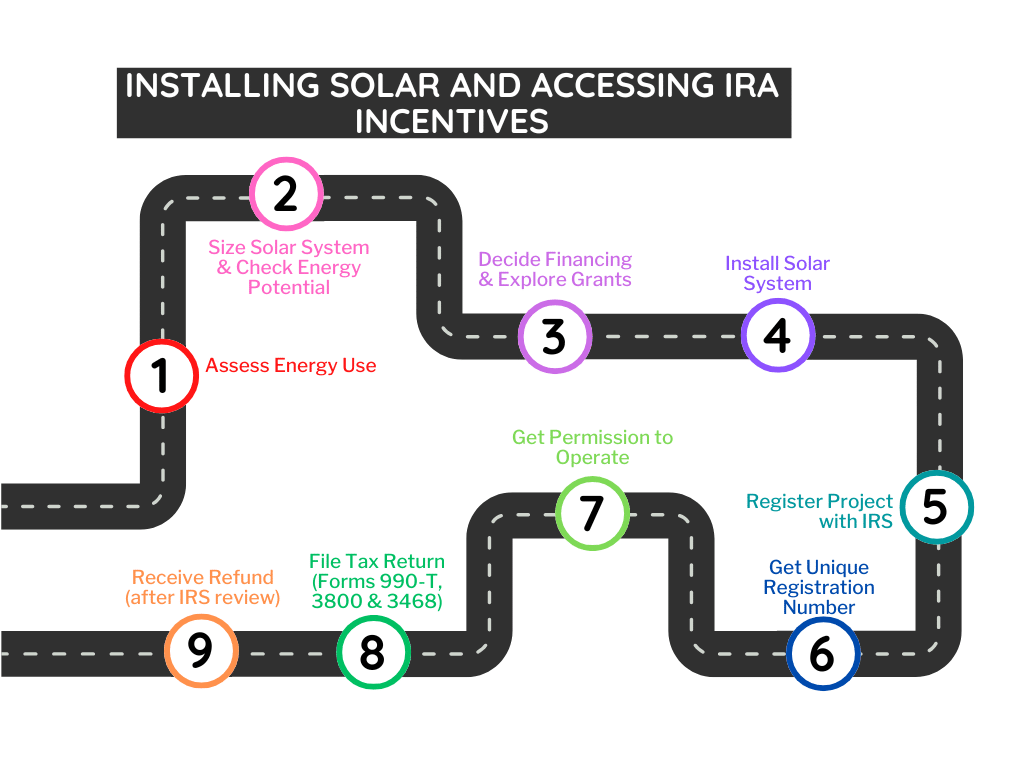

To install solar and take advantage of IRA incentives, local governments should start by evaluating their current energy consumption. This can be done through a review of electricity bills or by conducting an energy audit. Tools like PVWatts can help estimate the renewable energy potential of the site and determine the appropriate solar system size.

Once the system size has been determined, the project can be financed. Local governments can either fully own the system or pursue partial financing through state or federal grant programs to reduce initial costs. After installation, the project must receive permission to operate (PTO) from the local utility, officially placing the asset into service and determining the corresponding tax year.

Local governments can use the Clean Energy Tax Navigator to identify the direct or elective pay credits that apply to their project. The process for receiving these credits includes completing a Pre-Filing Registration and submitting forms 990-T, 3800, and Form 3468, and using a unique registration number to ensure all documentation is filed correctly. By following these steps, tax-exempt entities can fully leverage the IRA’s direct pay incentives, ultimately reducing solar project costs and making renewable energy a more viable solution for small WWTPs.

Conclusion

The transition to solar energy offers small WWTPs an opportunity to reduce operating costs, enhance resilience, and contribute to broader sustainability goals. The Inflation Reduction Act’s direct pay mechanism enables tax-exempt entities like local governments to now access the same federal tax incentives as private companies, making the transition to clean energy more accessible and financially viable. By taking advantage of these incentives, local governments can demonstrate the power of renewable energy to address both economic and environmental challenges.