When setting rates, most water and wastewater utilities are concerned (at least to some extent) about whether their customers can afford the resulting bills. Many utilities are also wondering how they can assist the poorest segments of their customer base with the cost of water/wastewater service. However, a frustrating problem is that a lot of low-income people live in multifamily housing, such as apartments, and do not actually have an account with the water utility. Even though they don’t receive a bill directly, these tenants are paying for the water/wastewater service indirectly via their rent. So some utility managers have been grappling with effective ways to provide assistance to these water users. Different theories involving vouchers etc. have been espoused, but one utility seems to have actually solved the problem.

The scenario for the success of this particular customer assistance program (CAP) from Seattle Public Utilities involves external factors outside the control of the utility (see point 3 below) combined with targeted and consistent efforts by the utility itself over the long term (e.g. point 4 below).

1. Reliable Funding Source for Customer Assistance Program (CAP)

In Washington, state statutes allow utilities to provide a “discount for low-income senior customers and low-income customers.” Even further, the state provides that the expenses and lost revenues from these discounts to hardship customers should be part of the cost of service calculations and “recovered in rates to other customers.” This puts utilities functioning in Washington State in a good position to reliably fund assistance programs. In contrast, many other states frown on the use of rates revenue from one set of residential customers being used to subsidize the rates of another set of residential customers, making it more challenging to secure funds to run a CAP.

2. Sharing a Billing System with Other Utilities

Where a water/wastewater utility shares a billing system with other utilities, there are opportunities to assist non-water account holders. For example, while many renters across the country live in situations with a master meter for water, electricity is usually sub-metered to individual rental units. This means that the renters receive an electricity bill. Seattle Public Utilities (SPU) and Seattle City Lights share the same billing system even though they are separate departments. SPU works with Seattle City Lights to provide a water credit on low-income customers’ electricity bills. Again, the rationale here is that when the landlord receives the master water bill, he/she passes on this cost to the tenants as part of their rent. So, SPU provides assistance to the tenant to cover that relevant portion of the rent.

3. Having a Relatively High Cost of Living

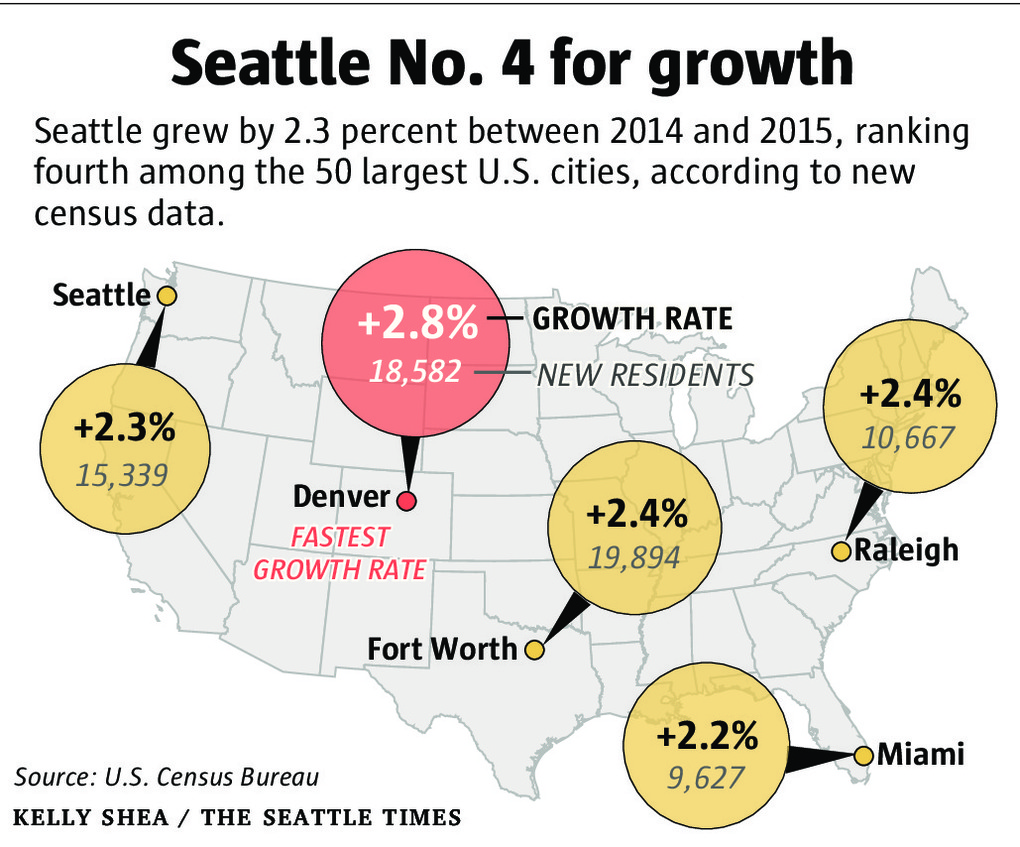

The City of Seattle is growing faster than most other large urban areas in the country, as illustrated in the diagram below.

Source: https://www.seattletimes.com/seattle-news/data/us-census-seattle-now-fourth-among-50-biggest-us-cities/ May 19, 2016

With this increase in growth comes a higher cost of living. The Bureau of Labor Statistics reports that in the Seattle area, over the last 12 months, the Consumer Price Index for All Urban Consumers (CPI-U) increased by 1.8 percent, compared to the 0.8 percent national rise over a similar period.

Community leaders see this high cost of living as a push factor causing poor people to migrate out of the City. Elected officials have made it a priority to address this issue through assistance programs for housing and utilities to the poor. The Utility Discount Program (UDP) to provide assistance to water customers with an income at or below 70% of the state median income is being used as one vehicle for this assistance.

4. Auto-enrollment of Low-Income Customers

Interviews with several large water utilities confirm that getting low-income customers to actually sign up for a CAP is a challenge. Several factors account for this, but the burden of paperwork and documentation for the subscriber is usually an important one. SPU has been able to reduce this burden for thousands of its low-income population by accepting eligibility for programs like Supplemental Nutrition Assistance Program (SNAP). People who have successfully enrolled in such related programs complete less paperwork in order to be enrolled in the UDP. In 2015, even people who did not receive a water bill, but lived in non-Seattle Housing Authority (SHA) multi-family housing were able to be auto-enrolled in the UDP program. This meant that over 3,000 tenants of non-profit housing organizations such as Catholic Charities were auto-enrolled into UDP.

On August 1st, 2016, Seattle made an even greater leap forward in enrollment numbers. Ordinance 125050 went into effect, making about 10,300 SHA households eligible for credits for SPU and City Light utility services. As in the case of non-SHA subsidized housing, these tenants are now auto-enrolled into the UDP.

SPU has even been providing assistance to a very small group of its service population who have neither a water nor electricity bill. Through a voucher system, a credit is provided to a renter in an aPodment® Suite, for example. The tenant is given about $52-$85 per month in the form of a voucher. When rent is due, the tenant turns in the voucher as part of the rent payment. The landlord then uses the voucher to pay part of the SPU bill.

Through its sustained efforts over time and recent program advancements, Seattle Public Utilities is currently able to provide financial assistance to just about any residential user of water in its service area. In the case of Seattle, certain extenuating circumstances, such as the high cost of living, are helping make this possible. If readers have other examples of water/wastewater utilities that have been able to provide significant financial assistance to non-water account holders, please share those examples below by leaving “a reply” or send an email directly to berahzer@unc.edu.