Read the previous blog, Financial Health Check for Your Water and Wastewater Utilities, to learn about some of the ways to gauge your water or wastewater system’s financial health.

If a wastewater or drinking water utility has concerns about its financial well-being, making informed, intentional choices to bolster that standing is important. However, it may take a bit of time and effort to get everything in order. The following approaches and suggestions show that establishing and maintaining consistency regarding utility policy, seeking external support in a variety of ways (usually at no cost to the utility), and ultimately maintaining transparency and fairness for all parties are all essential to stewarding a public utility forward in a prudent manner.

Establishing Internal Policies and Procedures for Your System–And Following Them

Thoroughly reviewing the financial concerns of a small wastewater or drinking water utility requires examination of the processes in place to ensure appropriate cost recovery and any actions/issues/problems that have made this difficult. If a utility’s ratios or other financial benchmarks suggest the utility is in a financially precarious position, a review of how and why that has happened must begin immediately. (see prior blog on a system financial health check to learn more about metrics.)

Systems may determine there are a variety of reasons for their shortfall or other financial issues. Increasing expenses due to aging infrastructure, poor maintenance, or inflation-related cost increases can mean yesterday’s rates are no longer adequate. Economic downturns, dwindling customer bases, or even water conservation ethos can mean that total revenue decreases, even though the utility charges the same rates—or potentially has increased them but not by a sufficient amount. Other externalities such as new required treatment standards, source water impairment, or the loss of a large customer, can pose a significant threat to a utility’s bottom line.

Each of these scenarios likely means tough conversations for a utility’s leadership. A review of the utility’s budget will likely be needed to assess the areas that are adequately funded and those that will need adjustments to meet the needs of the utility moving forward. It is also important to know how the budget has tracked with actual expenses on a month-to-month basis. Is revenue meeting the budgeted amounts or is it showing a shortfall on some or several months? If there are shortfalls, where has the utility cut expenditures to balance the budget? What are the immediate and long-term consequences of these actions?

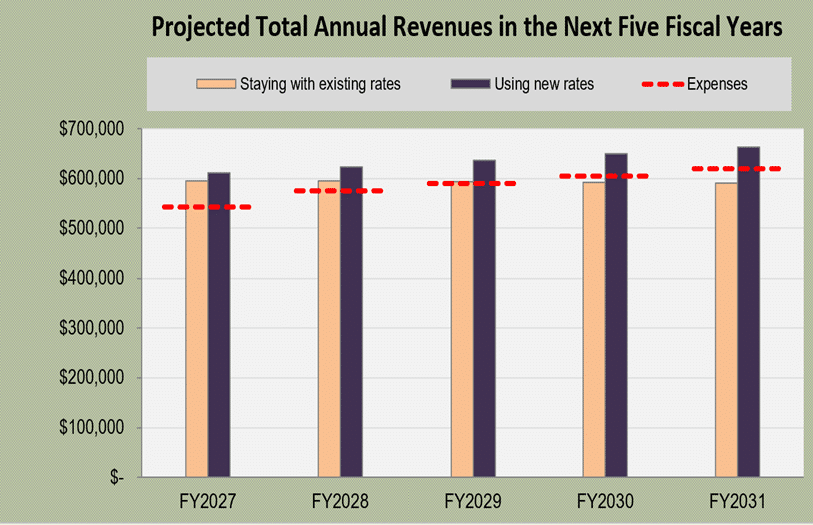

If shortfalls have occurred, it is important to revisit the current rate structure to determine whether changes may be required to generate more revenue (see prior blog on rate analysis). A review of payments may also reveal accounts in arrears. In such cases, applying utility policy for late payments and delinquency can bring in otherwise missing funds, as well as spark community engagement about how to address late or missing payments in the future. Scrutiny of both historical expenses and billing records can feel onerous but will help clarify if a utility is truly in need of a full financial recalibration or something less significant.

Other best financial practices can help ensure budgets are followed and good financial policies and procedures are in place and used. Some potential practices to consider implementing, if not in place already, include:

- Using double verification for writing checks

- Uniformly enforcing policy on late fees and reconnections

- Ensuring late fees and other penalties cover the full cost of the utility’s expenses

- Putting money in reserve accounts for emergencies, short-term replacements, some long-term capital expenses, debt service, and the like

- Establishing annual, gradual rate increases to accommodate for inflation and other changing costs over time

- Creating standard operating procedures for operation and maintenance to prolong the life of equipment

- Keeping excellent records to ensure future utility staff have appropriate guidance

- Establishing and following procedures for purchasing

- Engaging in asset management practices to establish lowest life cycle costs

- Approving all major financial decisions at open, public meetings

These items are just some of the ways to potentially improve your wastewater or drinking water system’s financial health both immediately and in the long term. Between transparency, internal controls and frequent self-assessment, some utilities can find ways to address rising costs without resorting to dramatic rate increases. For those who do need a major increase, this requirement can serve as an opportunity to reengage the community, to explain the value of clean water and public health for the community, to become invested in the utility’s mission, and ultimately to help provide the support necessary to be viable in the years to come.

Finding External Support–Technical Assistance and Funding

Small wastewater and drinking water systems may have trouble completing this review themselves. Finding external partners such as those in the Environmental Finance Center Network (EFCN) to help systems review their finances and rates is one approach. Similarly, a utility can work with external partners to get other technical assistance, be it with regulatory requirements, best operating procedures, asset management, and more. These partnerships are free to the utility and can result in increased revenue, higher customer satisfaction, and a lower total cost for the utility to maintain its preferred level of service.

Small utilities are unlikely to be able to afford to pay all required capital expenses out of their own revenue. There are many external sources of funding at the state and federal level that can help with asset renewals and replacements. Public wastewater and drinking water systems needing help with capital expenses can look to funding programs such as the State Revolving Fund (SRF), which can provide low-interest loans for capital improvements that may also include loan forgiveness. Other programs such as the USDA Rural Development funding, Community Development Block Grants (CDBG), or state funded programs provide means to access public funding at a reduced cost to the system and ultimately the community in which they serve. Technical assistance providers, such as the Environmental Finance Center Network, can help with determining which funding source or sources may be appropriate, help write applications, and help with getting the required documentation completed. All of this assistance is at no cost to a small water or wastewater system.

Another strategy for small systems to optimize costs is through collaboration, partnering, or regionalizing with other local wastewater and drinking water utilities. Examples can range from sharing equipment and operators to using the same billing software to formally creating a combined utility, which is often called regionalization. (If systems are interested in formal regionalization, many resources exist to explore this avenue further.) Whether informal arrangements or legally binding regional entities, establishing partnerships or working relationships with nearby communities can help reinforce a larger understanding that all water systems face similar challenges and pursue the same goals. Working together can reduce costs for some activities or share the burden between entities.

Conclusion

Ultimately, no silver bullet exists to pull a utility out of a budget shortfall or financial hardship. However, there are many ways to move forward that can help a wastewater or drinking water system rebound from a crisis. Systems are encouraged to access the plethora of external technical assistance providers who can help (usually at no cost to the utility) and to consider internal practices that can improve the situation. By working collaboratively and transparently, utilities can make concrete steps towards better financial health, ensuring that the needs of both today and tomorrow can be met.