I. The Infrastructure Needs and Challenges for Small Water Systems

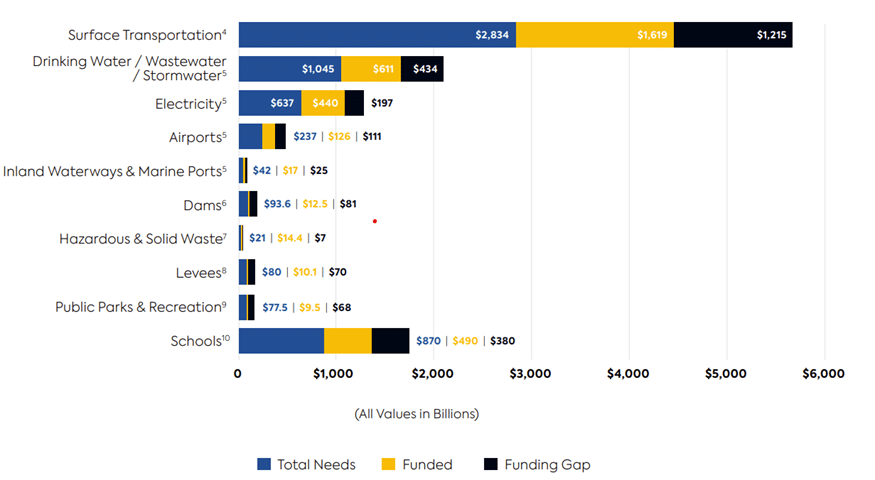

Small water systems in the U.S. face significant infrastructure challenges, including aging pipelines, outdated treatment facilities, and increasing regulatory requirements. According to the 2021 Infrastructure Report Card by the American Society of Civil Engineers (ASCE), the U.S. infrastructure received a C- grade, with an estimated $5.9 trillion needed between 2020 and 2029. However, only $3.4 trillion in funding is anticipated, leaving a $2.6 trillion shortfall. [1]

Small water systems, which often serve rural or lower-population areas, struggle even more due to limited revenue streams and fewer financing options. In 2023, the Environmental Protection Agency (EPA) estimates that the U.S. requires $625 billion in water infrastructure improvements over the next two decades.[2] Small water systems need targeted investments to address their specific needs and challenges.

While large-scale water systems may rely on a diversified mix of funding sources, small systems are heavily dependent on state and local financing, grants, and loans. These systems require tailored financial solutions to upgrade and maintain their infrastructure efficiently.

II. Financing Options for Public Infrastructure and Small Water Systems

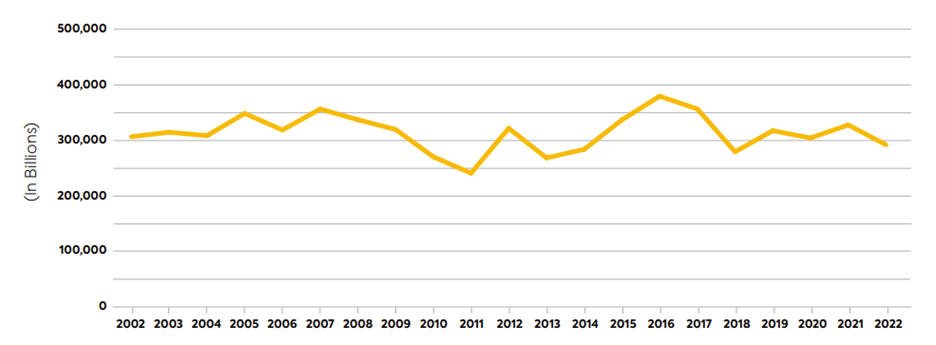

State and local governments have three primary methods to finance capital projects: 1) pay-as-you-go financing, 2) utilization of intergovernmental revenues such as federal and state grants, and 3) issuing bonds or obtaining other forms of financing.

Among these, tax-exempt bonds play a crucial role in fostering cooperation between the Federal Government and local communities. Presented here is a summary of essential bond instruments that state and local governments frequently utilize for financing infrastructure projects.

1. Tax-Exempt Bonds as a Key Financing Tool for Small Water Systems Tax-exempt bonds are a primary financing mechanism for public infrastructure, including small water systems. These bonds offer lower interest rates, making them attractive for long-term funding of capital-intensive projects such as water treatment plant upgrades, distribution line replacements, and storage expansions.

Two primary types of bonds used by small water systems include:

- General Obligation (GO) Bonds: These bonds are backed by the full faith and credit of the issuing municipality or local government. They are repaid through general taxes, making them ideal for small water systems with broad community support.

- Revenue Bonds: These bonds are specifically tied to the revenue generated by the water system (e.g., user fees). Since small water systems often have limited revenue bases, revenue bonds can be riskier but are feasible if the system has stable or growing customer bases.

The tax-exempt status of these bonds reduces borrowing costs, making them a cost-effective financing option for infrastructure expansion and modernization.

2. Additional Bond Financing Options for Small Water Systems

In addition to GO and Revenue Bonds, small water systems can leverage other tax-exempt and taxable bond instruments:

- Bank-Qualified Debt: If a small water system issues no more than $10 million in bonds within a year, the bonds qualify as “bank-qualified.” This designation makes them more attractive to banks, as it allows financial institutions to deduct a portion of interest expenses, lowering the cost of borrowing for the water system.

- Private Activity Bonds (PABs): Though typically associated with private sector projects, PABs can be used for certain public-private water infrastructure improvements. Small water systems can collaborate with private entities to access PABs, using them to fund water treatment or distribution projects. PABs include:

- Exempt Facility Bonds: Issued for public utility projects, including water and sewer systems. These bonds are suitable for small water systems seeking financing for large-scale capital improvements.

- Qualified 501(c)(3) Bonds: Small water systems operated by nonprofit entities, such as cooperatives or mutual water companies, may use these bonds to finance infrastructure improvements on a tax-exempt basis.

3. Direct Subsidy Bonds and Their Past Use

Direct subsidy bonds, such as Build America Bonds (BABs), were once a valuable tool for small water systems. These bonds offered a federal subsidy covering 35% of interest costs, significantly lowering the net borrowing expenses for local governments. Although no longer available, similar federal subsidy programs could be reintroduced to support water infrastructure funding.

Other direct subsidy programs included:

- Recovery Zone Economic Development Bonds (RZEDBs): Provided a 45% interest subsidy for public infrastructure projects, including water systems, in economically distressed areas.

4. Alternative Financing Options for Small Water Systems

Given the limitations of traditional bond financing, small water systems often turn to alternative funding methods, including loans and partnerships:

- Direct Loans: Small water systems frequently rely on loans from state revolving funds (SRFs), banks, or federal programs. These loans often have favorable terms and low-interest rates, making them suitable for capital improvement projects.

- Public-Private Partnerships (P3s): P3s offer an innovative financing model for small water systems. Under this arrangement, private companies fund, build, or operate water infrastructure in exchange for revenue-sharing agreements or service contracts. P3s can help small systems access upfront capital while leveraging private sector expertise.

III. Conclusion

Financing infrastructure for small water systems requires a diverse mix of traditional and innovative funding mechanisms. While tax-exempt bonds (GO and Revenue Bonds) remain the cornerstone for capital improvements, alternative options such as Bank-Qualified Debt, Private Activity Bonds, and Direct Loans provide additional flexibility.

To address mounting infrastructure needs, small water systems must strategically leverage these financing tools, combining grants, loans, and bond issuances to ensure long-term sustainability and reliable water service delivery.

Acknowledgement:

This blog is revised based on this GFOA’s material: Understanding Financing Options Used for Public Infrastructure: https://gfoaorg.cdn.prismic.io/gfoaorg/Z5pn-pbqstJ9-AfR_PFNPrimer_119thCongress_FINAL.pdf

References

[1] Source: https://infrastructurereportcard.org/

[2] Source: https://www.epa.gov/system/files/documents/2023-09/Seventh%20DWINSA_September2023_Final.pdf

[3] Source: https://gfoaorg.cdn.prismic.io/gfoaorg/Z5pn-pbqstJ9-AfR_PFNPrimer_119thCongress_FINAL.pdf

[4] Source: https://gfoaorg.cdn.prismic.io/gfoaorg/Z5pn-pbqstJ9-AfR_PFNPrimer_119thCongress_FINAL.pdf